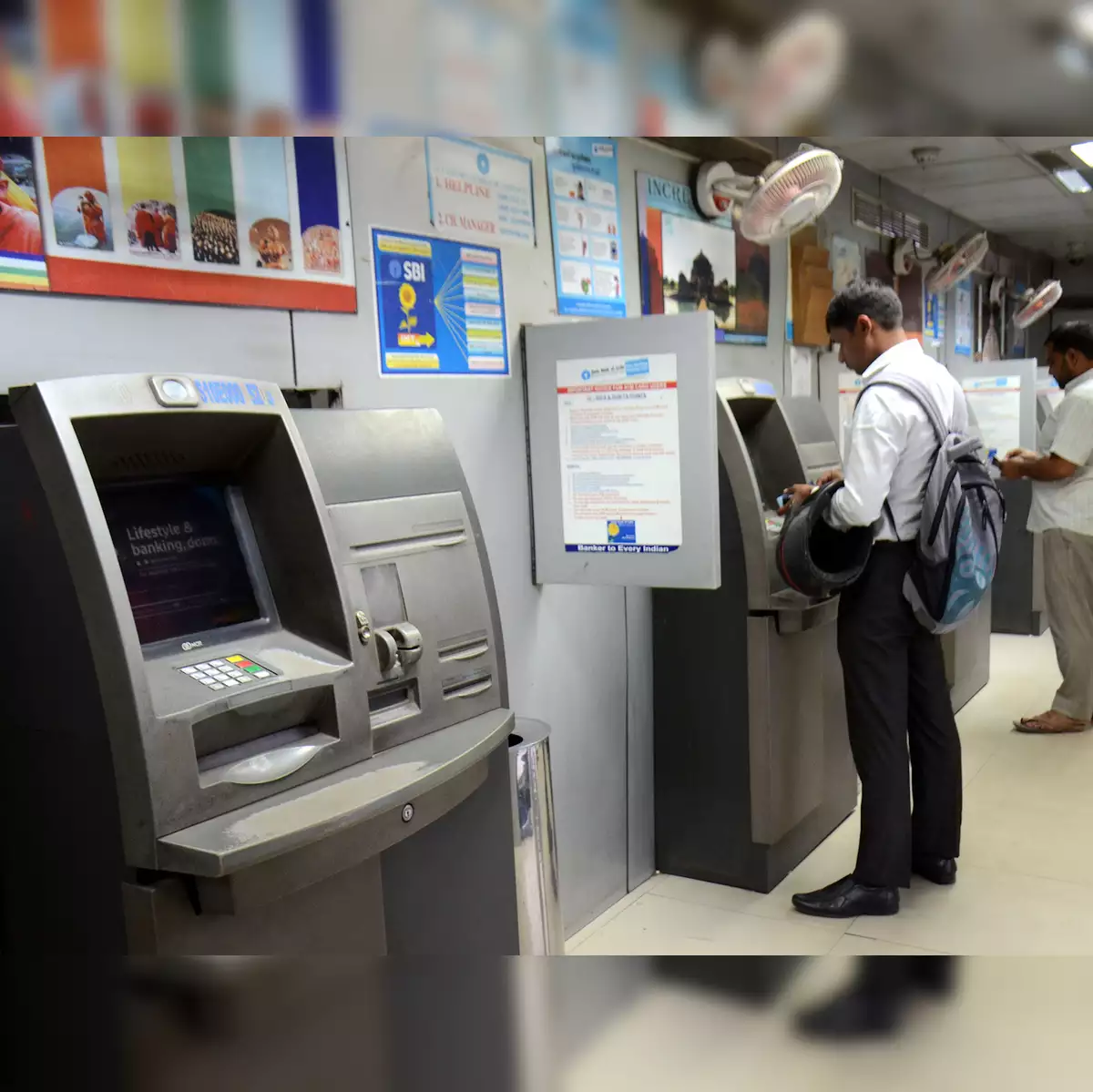

Delhi, February 5, 2025 (Punjab Khabarnama Bureau): If you frequently withdraw money from ATMs, this news could be important for you. In fact, there is a possibility that the charges for withdrawing cash from ATMs may increase. According to reports, the Reserve Bank of India (RBI) is planning to raise the costs on transactions beyond the 5 free transactions limit and ATM interchange fees imposed by banks on customers. Citing sources familiar with the matter, Hindustan Businessline reported that the increase in charges means bank customers will have to pay more for withdrawing cash from ATMs. The National Payments Corporation of India (NPCI) has suggested that the maximum charge for cash withdrawals after the 5 free transactions should be increased from ₹21 to ₹22.

NPCI’s recommendation to increase several charges: NPCI has also proposed an increase in ATM interchange fees. The interchange fee for cash transactions is recommended to rise from ₹17 to ₹19, while for non-cash transactions, the fee should be increased from ₹6 to ₹7.

What is ATM interchange charge?

Let me explain that the interchange charge is the fee that one bank charges another bank when a customer uses an ATM of a different bank to withdraw cash or avail other services.

For example, if your bank is SBI, but you use an HDFC Bank ATM to withdraw cash, in this case, HDFC Bank charges SBI an interchange fee for processing your transaction.

Summary: ATM usage is set to become more expensive, with higher charges being imposed on cash withdrawals, affecting users across the country.