18 July 2024 Punjab Khabarnama : Envision Capital’s Nilesh Shah believes e-commerce and fintech are two themes that could see ‘hyper-growth’ in the years to come, offering opportunities for outsized returns going forward.

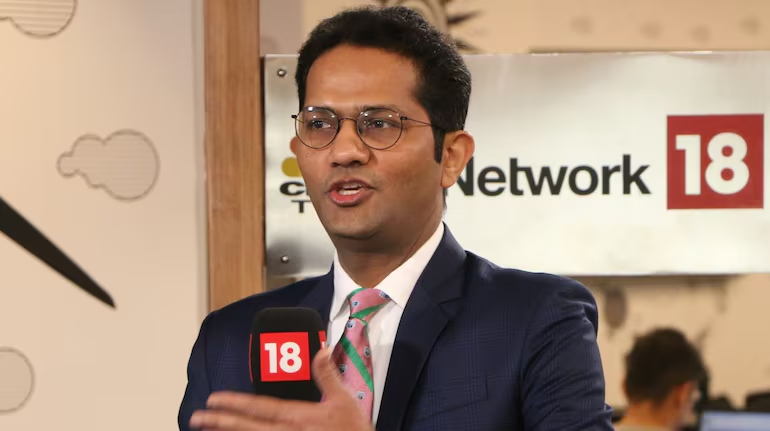

“I believe the next five years belong to fintechs”, Nilesh Shah said in a conversation with CNBC-TV18, adding that some of the major online consumer internet plays and companies providing support to the Digital Public Infrastructure (DPI) could be the flavour in the next phase of the market rally.

India’s DPI includes technology stack such as Aadhaar, the Unified Payments Interface (UPI), FASTag and others. Earlier this year, a NASSCOM estimate had projected that the value generated by these could rise three-fold from 0.9 percent of GDP in 2022 to 2.9-4.2 percent of GDP by 2030.

New pockets or themes powering the stock market have been emerging in the past too, with every 5-10 years seeing a rotational change in the leadership of the market, Shah noted, recalling that private banks were one such theme some years ago, followed by PSUs. In the next phase of the market rally, fintechs are likely to emerge and provide this leadership to the market, Nilesh Shah said. “These businesses will see hypergrowth, and will compound at 25-30 percent YoY for next ten years”, he added.

Valuation Worries

From a 3-5 year perspective, investors can hope to find pockets of reasonable valuations in the market, according to Nilesh Shah. He said Envision Capital has trimmed positions in the Capital Goods space, where businesses have grown 25-30 percent in just few years but market capitalisation has increased many folds. “We are not exiting but pruning down”, he said.

Budget and Markets

The market has had a lot of noise around taxation in the run up to the budget. Nilesh said he would like to watch out if the Budget only focuses on the continuity aspect or there will be new changes that the Finance Minister could announce. He is hopeful that the focus on infrastructure amplifies further this year. Social spending will likely take centre stage which will prop up the rural economy, Nilesh added.

The financialisation theme too appeals to Nilesh Shah – as captured by the rising flow of domestic funds from continued SIPs – who is Overweight on some of the insurance players, AMCs and distributors of financial products, while IT may have had its best days behind them, he said.

Chris Wood of Jefferies too spoke of a growing equity culture in India, similar to the surge in equity participation in the United States in 1980-2000s. “Fundamentally it is extremely healthy that the Indian market is driven by domestic flows and not what the foreigners are doing,” Chris Wood had noted.