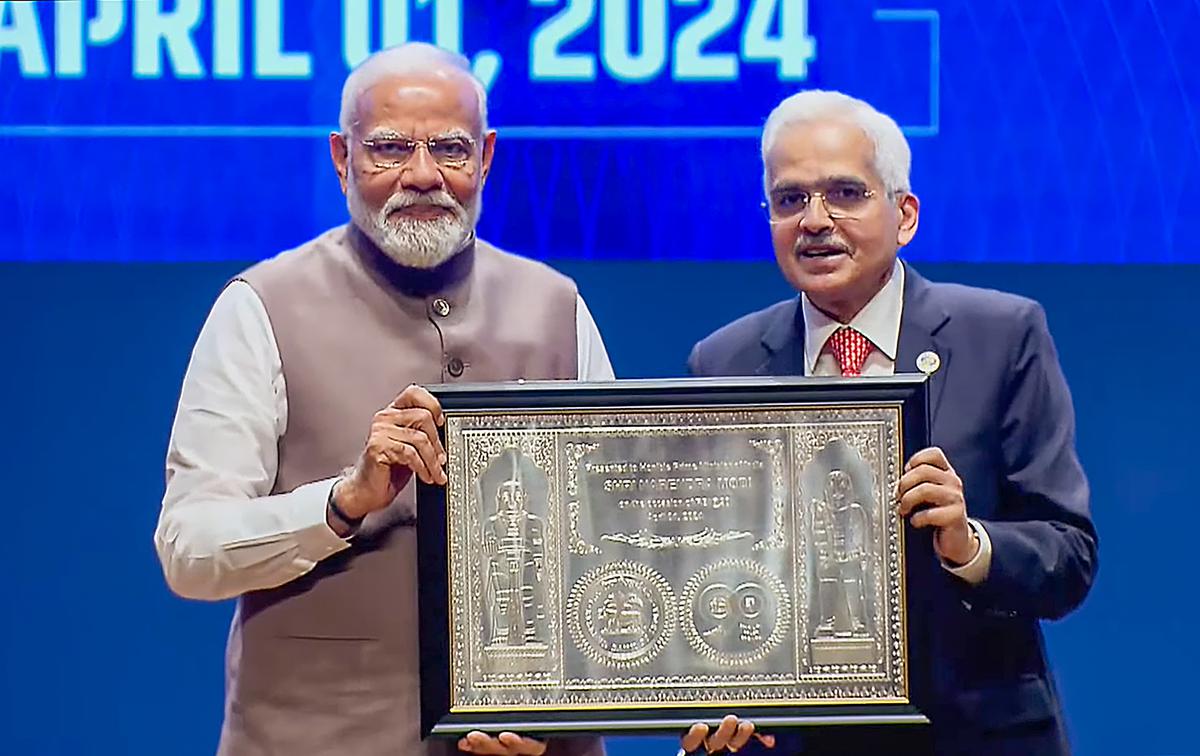

April 01 (Punjab Khabarnama) : Prime Minister Narendra Modi on Monday (April 1) said there is a need to improve India’s economic self-reliance so that the country is less affected by the challenges from around the world. Speaking at the commemoration of the 90th year of Reserve Bank of India (RBI), Modi emphasised that the steps should be taken to make the rupee more acceptable and accessible to the world.

“In the next 10 years, we need to make India’s economy self-reliant. We have to make efforts to ensure that our economy is much less affected by the crisis from across the world,” he said.

The prime minister said today India, with its contribution of 15 per cent in global GDP growth, has become the growth engine of the world.

“In such cases, the effort should be that the rupee is more accessible and acceptable in the world,” he said.

India is aiming to make the rupee a global currency. Last year, an RBI-appointed Inter-Departmental Group (IDG) had recommended a slew of measures, including inclusion of the rupee in the Special Drawing Rights (SDR) basket and recalibration of the foreign portfolio investor (FPI) regime to accelerate the pace of internationalisation of the rupee.

The prime minister praised the RBI for its efforts in improving the health of India’s banking sector and the economy.

“In 2014, when I attended the RBI’s 80th foundation day, the situation was very different. India’s banking sector was dealing with different challenges. Due to higher NPA levels (of banks), everyone had doubts about the banking sector’ stability and its future,” PM Modi said.

The situation was so bad that public sector banks were unable to provide the required push to the country’s economic growth, he added.

PM Modi said because of various measures taken in the last 10 years, India’s banking system is now considered as a strong and sustainable system in the world.

The government made a capital infusion of Rs 3.5 lakh crore in public sector banks and undertook many reforms to strengthen their governance, which has helped in improving their health.

The Insolvency and Bankruptcy Code (IBC) alone has helped to resolve bad loans worth Rs 3.25 lakh crore. Over 27,000 applications with an underline default of over Rs 9 lakh crore, were resolved before admitting to the IBC.

The gross NPAs of banks, which were at 11.25 per cent in 2018, has come down to below 3 per cent at the end of September 2023.

The twin balance sheet issue is now history. Banks credit growth is at around 15 per cent, he said.

“The banking system, which at some point of time was on the verge of collapsing, has become profitable and is showing higher growth in credit,” Modi said.

He said it was not easy to transform the banking sector in the last 10 years. This improvement came because there was clarity in the government’s policies, intentions and decisions. It was also possible as the government made concerted efforts, and with honesty.

“…if intentions are correct, policies are right. If policies are correct, decisions are right, and when decisions are right, the outcome will also be right,” Modi said.

Speaking on inflation, the prime minister said 10 years ago, the financial policies did not reflect the intention to deal with double digit price rise.

To overcome this, the government provided the RBI the inflation targeting framework, on which the Monetary Policy Committee (MPC) has made good success, he said.

The government also took steps related to active price monitoring and fiscal consolidation.

“It is because of this that despite Corona and wars between different countries, inflation in India is at moderate levels. The country which has set its priorities with clarity cannot be stopped from making progress,” Modi emphasised.

Under the inflation targeting framework, The government has mandated the RBI to keep inflation at 4 per cent with a band of +/- 2 per cent. The RBI has been targeting to bring consumer price-based inflation to 4 per cent on a sustainable basis.

In February, consumer price-based inflation (CPI) or retail inflation stayed flat at 5.09 per cent against 5.1 per cent recorded in January.