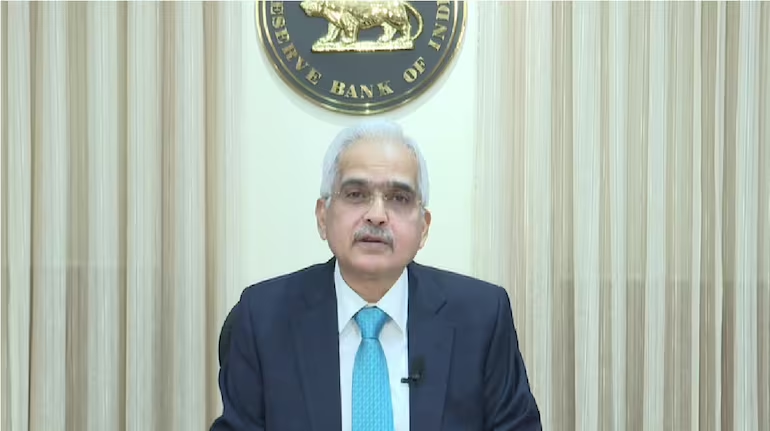

3 July 2024 Punjab Khabarnama : On July 3, Shaktikanta Das, the Governor of the Reserve Bank of India (RBI), conducted meetings with the Managing Directors and Chief Executive Officers of public sector banks and certain private sector banks in Mumbai. During the meetings, Das urged them to enhance their efforts in combating ‘mule accounts’ and emphasized the need to increase customer awareness and educational initiatives as part of the measures to prevent digital frauds.

A mule account is an account that is created by one individual but operated by another individual. These accounts are frequently utilized for the purpose of money laundering and evading taxes. Mule accounts are considered to be in breach of multiple regulations and can be subject to prosecution under the Prevention of Money Laundering Act (PMLA). Additionally, these arrangements are unlawful according to tax legislation. Even the Securities and Exchange Board of India (Sebi) and the Reserve Bank of India (RBI) have regulations stating that the use of such accounts is prohibited.

Das also stressed the importance of banks in guaranteeing strong cybersecurity measures and efficiently handling risks associated with third-party entities.

According to RBI’s release, the meeting covered various topics including the persistent gap between credit and deposit growth, liquidity risk management, ALM-related issues, trends in unsecured retail lending, cybersecurity, third-party risks, and digital frauds.

During the meeting, there were also discussions on enhancing assurance functions, improving credit flows to MSMEs, promoting the use of Indian Rupee for cross-border transactions, and encouraging banks to participate in innovation initiatives of the Reserve Bank. Das emphasized the significance of enhancing governance standards, risk management practices, and compliance culture in banks.