07 June 2024 Punjab Khabarnama : The Reserve Bank of India’s Monetary Policy Committee (MPC), which had kickstarted its meeting on Wednesday, has kept the repo rate unchanged at 6.5 per cent for the eight consecutive time. This is the first time the MPC met after the results of the Lok Sabha election were declared.

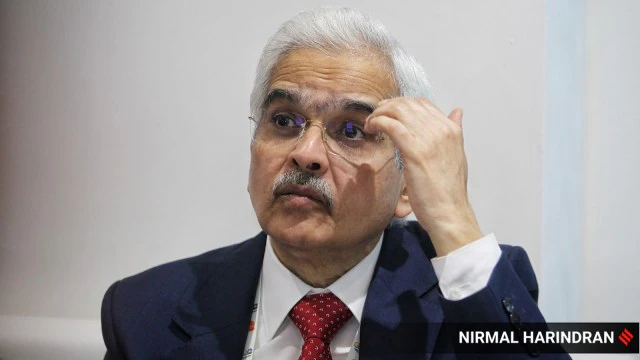

Addressing a press conference, RBI Governor Shaktikanta Das revised the GDP (gross domestic growth) projection to 7.2 per cent for FY 25, up from 7 per cent that it had expected earlier.

The stock market cheered the hike in GDP forecast with the Sensex rising nearly one per cent, or over 700 points, to the 75,814 level soon after the policy announcement.

The government has mandated the RBI to ensure CPI inflation at 4 per cent with a margin of 2 per cent on either side.

In April, the Central Bank had decided to keep the repo rate unchanged at 6.5 per cent and maintain the policy stance of ‘withdrawal of accommodation’ in the monetary policy. Both the decisions were taken in a majority 5:1 voting by the six-member MPC, headed by Das.

With the RBI keeping the repo rate steady, all external benchmark lending rates that are linked to the repo rate will not rise, providing a relief to borrowers as their equated monthly instalments (EMIs) will not increase.

However, lenders may raise interest rates on loans that are linked to the marginal cost of fund-based lending rate, where the full transmission of a 250 bps hike in the repo rate between May 2022 and February 2023 has not happened.